Centre of Excellence

-

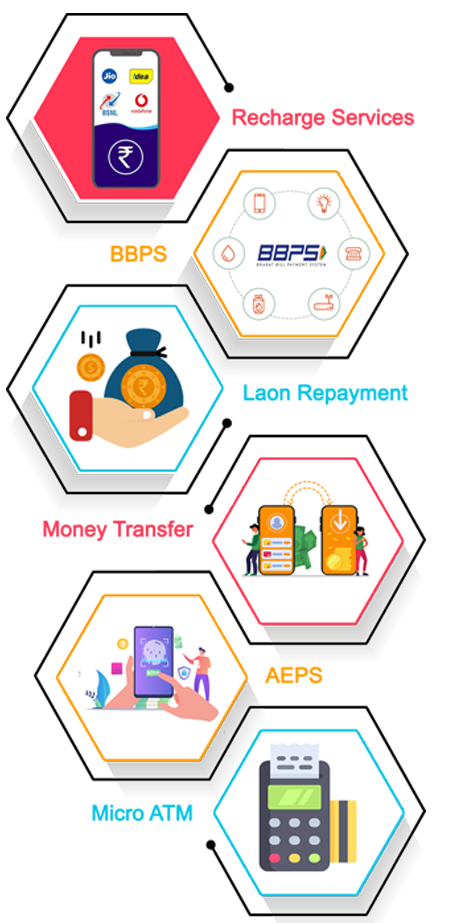

Recharge Services

API interface Stands for "Application Programming Interface" which is a convention (set of principles and controls).

-

Money Transfer

Domestic Money Transfer (DMT) benefit is an enormous market in India which got much more lift with current increment in advanced exchanges.

-

BBPS

Bharat Bill Payment System facilitates the installment of bills and enhances the security and speed of bill pay.

-

AEPS

Aadhaar Enabled Payment System (AEPS) is a sort of installment framework that depends on the Unique Identification Number and permits Aadhaar card holders.

-

Loan Repayment

Rpayment is the act paying back money previously borrowed from a lender.Typically, the return of funds.

-

Mini ATM

We have a solid arrangement of POS administrations, which enables clients to effectively pick and pick the coveted administrations for meeting their business destinations.

FULLY RESPONSIVE DESIGNS

Design rendering and working as per the user’s behavior and environment based on screen size, platform and orientation allows the maximum reach across the devices.

INTUITIVE WORK FLOWS

An intuitive interface has clue that how the process is supposed to flow so that user don’t have to experiment the interactions, based on real-world experiences, no surprises are thrown. It ensures a “no-frustration” user experience.

EASY MANAGEMENT

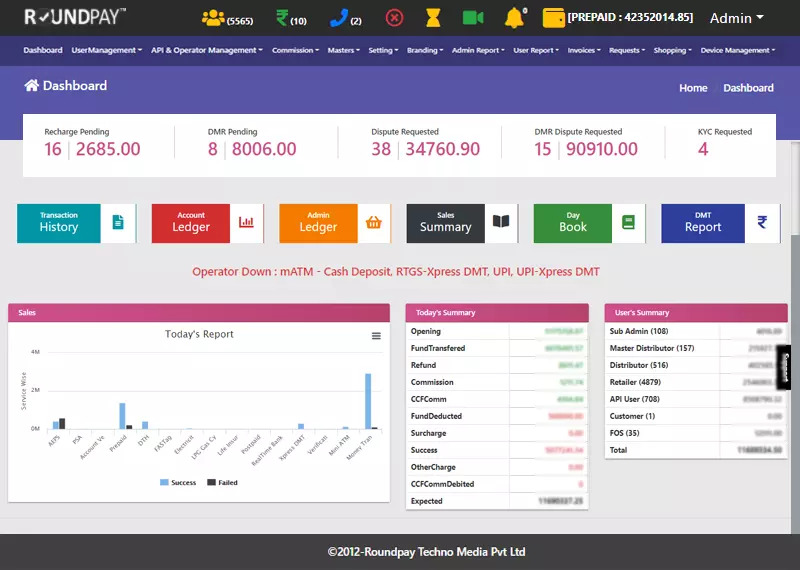

All of your tracking and analytics will get condensed into a single report, allowing for easier monitoring/analysis and strategy formation for your business to develop and become simpler, and achieve its objectives much faster.

COST EFFECTIVE SOLUTIONS

Fully responsive web applications saves on development and maintenance costs as all the efforts are directed in building a single interface for all the devices. This also leads to positive impact on the sales & conversion rates as user experience remains consistent.

Fastest way to grow Direct Selling Business

Our application and revive entryway is absolutely easy to understand which is simple to make with appropriate security.

- Best UI and UX

- Dynamic Recharge API Intigration in Admin Control - No need of Devloper

- Multiple Commission Module to manage Team

- Whitelabel Solution

- Customer Care Panel with Dynamic Access Control By Admin

- Sales Team Managemnt with Real time Reporting

- FOS- for field Collection and Sales

- Realtime Billing Module

- All Requierd Reports for Bussiness Analysis

- Userwise Routing for Recharge

- Circle Wise Recharrge Routing

- Denomination and Range Wise Rounting

- Seprate Backup Api Mechanism for API Partner and Retail

- Cutomise Alerts of All Events

- Email Mesaage and Social Alerts

- APP Notification as per Requierment

- Multiple Payment Gateway Support

- Multiple Money Transfer and AEPS API Support

Why Choose Us

Easy Integration

Singup and go with easy integration feature for your web and mobile applications.

Fast Response

We use RESTFul APIs which deliver fastest response over requests made from web or mobile devices.

24X7 Support

Our customer service is best in class and commited to serve you 24x7 for your queries and questions.

For All Platforms

No worries of technology or platform your application is built on we support all of them.