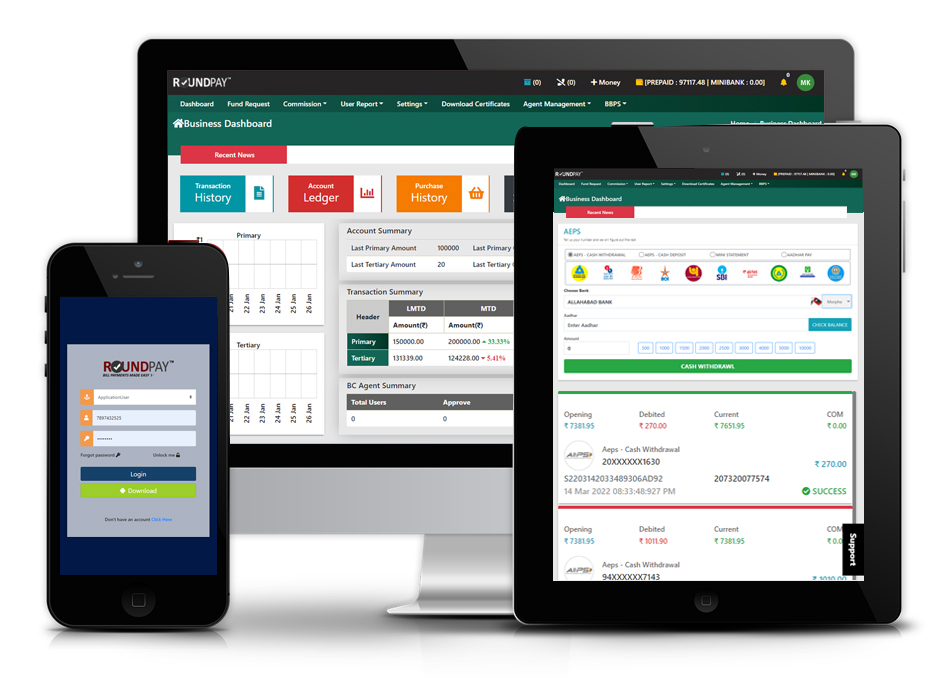

Aadhaar Enabled Payment System API

In association with Fingpay and Fino Bank, Roundpay is one of the leaders in the Business Correspondent space, providing AEPS solutions to more than 300 distributors across the country. With our seamless integration, you, as a distributor can be live and running in 48 hours.

Aadhaar Enabled Payment System (AEPS) is a sort of installment framework that depends on the Unique Identification Number and permits Aadhaar card holders to consistently make money related exchanges through Aadhaar-based confirmation. The AEPS framework plans to enable all areas of the general public by making budgetary and saving money administrations accessible to all through Aadhaar. AEPS is only an Aadhaar-empowered installment framework through which you can exchange reserves, influence installments, to store money, influence withdrawals, to make enquiry about bank adjust, and so forth. AEPS Software enables clients to make installments utilizing their Aadhaar number and by giving Aadhaar confirmation at purpose of Sale (PoS) or smaller scale ATMs.

This is a straightforward, secure and easy to understand stage for money related exchanges. This is another activity taken by the National Payments Corporation of India (NPCI) to empower cashless exchanges in India.

Roundpay is one of the best company which provides you API for AEPS. By integrating the Aadhaar Enabled Payment System you API in your portal you can able to transfer funds using your aadhaar detail.

The main information sources required for a client to complete an exchange under this situation are :-

- IIN (Identifying the Bank to which the client is related)

- Aadhaar Number

- Unique mark caught amid their enlistment